Thank you Lexington Law Firm for sponsoring this post. A high service partner and consumer advocate that will help you fight for the credit you deserve!

Hey All!

Today I’m going to get very personal and share something with you that I’ve been hesitant to share about in the past. What I’m going to share is how I’m doing everything I can to repair my credit score and get debt free. I confess, I’ve never been good at managing money and I was a shoppaholic for most of my life. These two things spelled disaster when I was older and had medical bills, student loans, credit card debt, and became the victim of Identity theft. Yes I have experienced ALL OF THE ABOVE and because of all of those things my credit score is terrible!!!! It’s a big issue to have as your credit score is looked at when you’re trying to buy a house, a new car, or even when renting an apartment. Thankfully my hubby has great credit, so we’ve been able to get by with his credit when we had to move etc. He essentially vouches for me and my bad credit in situations where we need to be considered credit wise. I’m tired of being the one who brings us down with my poor credit, so I’m focusing on repairing my credit this year. I’m doing it with great tools and services like Lexington Law Firm.

I had a consultation with them recently and discussed my issues with everything I mentioned above. We primarily focused on late payments and medical bills that did not get paid by my insurance company, even though the insurance company was supposed to pay them. Did you know a late payment or derogatory mark from a creditor can have long-standing consequences, in some instances staying on your report for seven years? I know it seems like not a big deal at the time, but late payments do bring down that FICO® Score. I know from experience as I missed a payment on one credit card and it immediately brought it down! If you didn’t know, a FICO® Score is a credit scoring system that uses a proprietary algorithm that takes into account one’s credit files across the three main credit bureaus Equifax, Experian, and TransUnion to calculate one’s lending risk. It’s what 90 percent of financial institutions base their lending decisions on. The higher your score the better! It may take me a long time to repair my score, but I know it can be done.

I monitor my score and my credit reports as a first step to trying to repair my credit score. You can get your reports for free once a year. If you see anything that doesn’t seem right on your credit report, thankfully there are Acts such as The Fair Credit Reporting Act (FCRA), Fair Credit Billing Act (FCBA), Fair Debt Collections Practices Act (FDCPA), The Servicemembers Civil Relief Act (SCRA), The Truth in Lending Act (TILA), and the Health Insurance Portability and Accountability Act (HIPAA), that give consumers the legal right to dispute inaccurate items on their credit reports with the credit bureaus and individual creditors. Working with a company like Lexington Law Firm, who has long-standing relationships with all three of the credit bureaus: Equifax, Experian, and TransUnion, can help you get any disputes off your credit report. In my opinion, it’s much harder to do without help. Trust me! I’ve done it both ways and having help is always better. Their relationships and a deep expertise in knowing how getting errors removed works, enables theLexington Law Firm team to communicate more efficiently for their clients.

It’s great to learn all this info from a company like Lexington Law Firm. They have great online tools as well that really showcase how I can keep money in my purse while also repairing my credit. Lexington Law Firm understands the complex consumer protection laws and helps people like me understand our rights and use the law to fix our credit errors. If you’ve never heard of Lexington Law Firm, they are one of the oldest and most respected name in credit repair. They are also the only player in the category with the legal experience and technology to both advocate and drive results for consumers. I love them because they are also affordable with packages starting at just $24.95 per month. It’s great to have someone to help me on this journey to repair my credit.

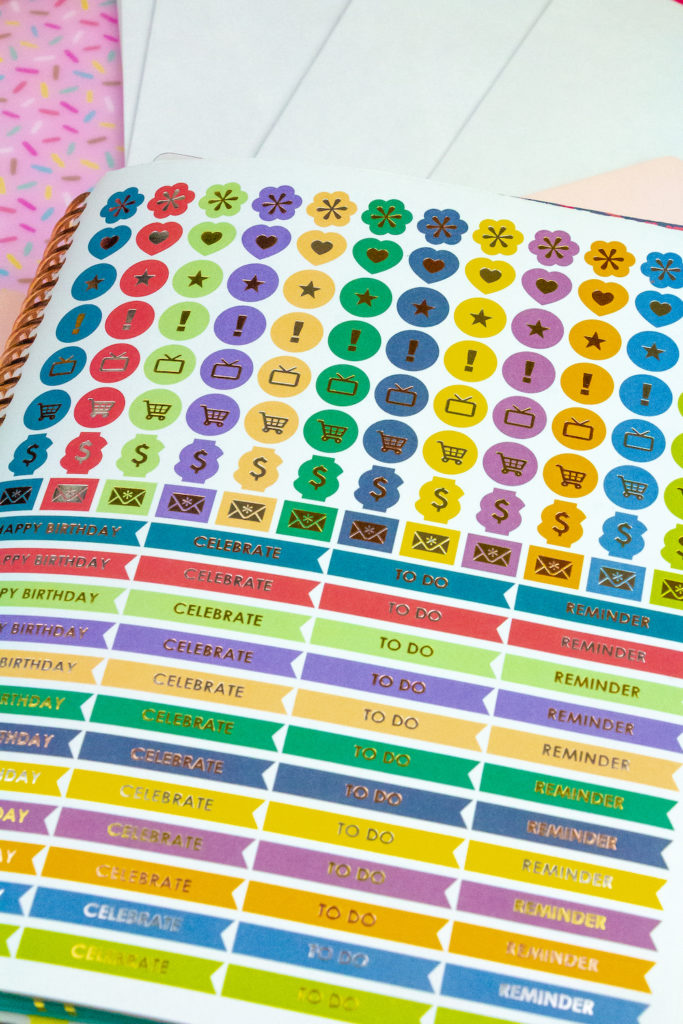

With what I learned from our consultation, I’m definitely going to use this service this year to help me on this journey to repair my credit. I’m also focusing on being debt free, which will surely help me bring up my score. I’m barely shopping these days and focusing on paying off my credit cards. I’m making sure I clean up my credit report and pay all my bills on time. I came up with a system using stickers to show when I’ve paid off a bill or need to pay a bill. I print out a spread sheet of all my bills for the month and I use a little money sticker to mark that the bill has been paid. I use celebrate sticker to mark the bill has been paid off.

Any bills that I have that still come in the mail, I mark them with an envelope sticker. This helps me keep track of all our bills and makes sure everything is paid on time. I’m very busy and things like due dates can get away from me. I make sure to have all due dates in my spread sheet so I don’t miss them. I was advised on my consultation to not close the credit cards and to keep them open and in good standing until my score improves. Once it does I can decide if I want to get rid of the annual fee and high interest cards that I don’t really want.

I know by the end of this year I’ll have reached the end of the road and debt free and my credit score will be so much better with the help of Lexington Law Firm. When working with Lexington Law Firm, I feel I’ll have peace of mind knowing I have legal experts that are going to fight for my rights on this credit journey.

If you’re looking to repair your credit this year I highly recommend you check out Lexington Law Firm now! They can surely help you get your started on the path with a free consultation.

Thanks for supporting the amazing brands like this one that keep this Brite & Bubbly party going!

Comments

Working on improving my personal credit as well. There are some great tips here

Fixing credit can take some time with with a plan and organization it can definitely be done. There are different factors too and it’s great to have a helpful resource!

It is my dream to one day be debt free! If I could just rewind back to college and tell myself not to apply for all of those cards!

Great tips here!! Thanks for sharing!

My credit score isn’t the best as well. And with the student loan crisis we all seem to be in danger. It’s best to fix your credit for sure start small and pay on time is key.

This is really a serious matter. Fixing your credit score is really not easy but I am happy that you found someone to lean on and helping you with this journey.

These are great ideas to get organized and work towards becoming debt free. Thanks for the great read!

What a grwat topic to be discussed. This is everyone dream, to be a debt free. Thabk you for sharing such a helpful information.

Everyone strives to be debt free. Information like this is important to help people have a financial freedom. Thanks for sharing.

I am absolutely in love with your planner, I’d stay on top of my stuff with something like that! So glad to hear you’re adulting! I could use some of that juju

Sometimes, money can be a real burden. Good for you on getting it together and working towards bettering it! It’s never too late!

You have some great thoughts about how to get your finances in order. Great credit is so important for buying a house or getting a car loan. We tend to minimize our loans when possible. I love your cute photos!

Our goal is to be debt free by the end of the year, as well! I love how you are going to accomplish your goal; we have a similar method! Good luck!

I try to pay the biggest debt first and look at the smaller one. Housing loan can be a pain and years to serve.