Thank you CreditCards.com for sponsoring this post. Visit CreditCards.com today to find the right card for you.

Hey All!

I don’t know about you, but I love to shop. I’m a little bit of a shop-a-holic, but I’m a responsible shopper. I don’t spend a ton of money every day or month, because unlike my credit card clutch says, I don’t want to be broke! I like to benefit from shopping trips in more ways than one. I make lots of small shopping trips, so I can build my rewards points on my credit cards. My credit card rewards help me to save on everything from travel to gas each month. Some of my rewards equal to cash back rewards, which sometimes means the stuff I’m buying is free. Thanks to the folks at CreditCards.com I’ll be sharing how small spending can lead to big rewards!

If you’re not getting lots of rewards and benefits from your current credit cards you should definitely check out the Rewards Credit Card Reviews on CreditCards.com. Through innovative tools, experiences and advice, CreditCards.com helps people find the right cards and use them the right way—everyday. CreditCards.com rates and reviews credit cards to provide objective, useful comparative information to help you choose the right card for you. Reading those reviews will help you find the right card with the right rewards perks to fit your lifestyle!

As a blogger and content creator, I do a lot of styled photography for brands, I travel, and cover lots of events. I have to always shop for props, the latest trends and fashions to show off in my photos and blog posts. This work and lifestyle benefits from lots of weekly small spending, which can help me build up my credit card rewards. I often check with my cards to see where to shop and what products will bring me double or bonus rewards or cash back each month. For example, this month was double rewards on gas, so I made sure I used my credit card to fill up my car this month.

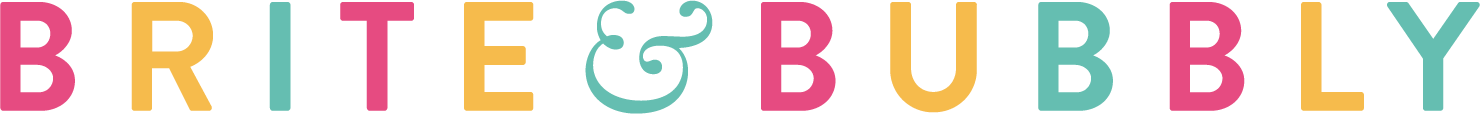

Shopping for accessories and cute and colorful office supplies all summer long for my styled posts and to wear to events helped me build my credit card rewards.

All those small shopping trips along with using my credit card to make purchases on gas and groceries each week help me build up my rewards points quickly. Doing small purchases more often, as opposed to just one large purchase a month, will help you build up those rewards faster.

After a few months of building up all my rewards, I either save them so they build up to a higher amount or I cash them in to take a fun trip or for cash back. They cash back will help me pay for the credit card bill, which allows me to save some of the money I would have used to pay the credit card. When that happens, I put that money in my savings.

Recently, I benefited from my credit card rewards in a big way! I used my rewards from shopping all summer to take a trip to San Fransisco to see The Color Factory! The hotel, air fare, and transportation was all paid for with my rewards points! I essentially got a free trip from my small shopping trips all summer! How awesome is that folks? It was a huge benefit, as I got to visit a pop up exhibit that I was dying to see before it closed.

I was swimming in a giant yellow ball pit…

And dancing around in confetti on this trip. I had the best time ever and it was all thanks to my credit card rewards!

If you’re not living it up like I am with your rewards credit cards, I highly recommend you check out the Rewards Credit Card Reviews on CreditCards.com. They are call rewards credit cards for a reason and you should be getting your rewards!

Thanks to CreditCards.com for helping me find the best rewards credit cards for my lifestyle! CreditCards.com’s goal is to help people seize greater opportunity through smarter spending. Take advantage of their site now!

I was selected for this opportunity as a member of CLEVER and the content and opinions expressed here are all my own.

Comments