I recently had the amazing opportunity to attend a dinner that was hosted by ScholarShare. It was an opportunity to discuss an important subject that I have spoken about many times on this site, which is saving for your children’s education. Scholarshare is California’s 529 College Savings Plan that allows families or relatives to save money for college for their children or family members. It’s an amazing program.

It was an amazing night filled with lots of laughter and I learned a lot about this amazing program. The key I learned about this program is that it’s never to early to start saving for college. You can start as early as when they are still in your belly. I was not fortunate to have a college savings plan waiting for me when I went to college. I had to take out student loans and I essentially came out with over $160,000 in student loan debt simply because I wanted to get a good education. It’s sad, but that’s the situation of many people and kids today. It’s extremely stressful when you graduate from college if you come out with debt. I never wanted to have that happen to my children, so I set up a savings account some time ago, but I wish I would have know about a 529 as it’s so much better as it’s tax free. It’s tax free if you use it for qualified school purposes like buying books, paying for school, etc. It only takes $25 to open an account and you can set as much or as little as you want to go into the account every month. You can set it to automatically deduct from your bank account, which means you can set it and forget it. Yes it’s a California 529 College Savings Plan, but you don’t even have to live in California to open one!

You can even send out gift emails asking for donations to the fund as a gift idea or have relatives put money into the account! If you don’t have your own kids now, you can still set up an account for grand kids, nieces and nephews. You can change the beneficiary of your account when you do have kids or you can open a new account for your own kids. You can have multiple accounts for different kids.

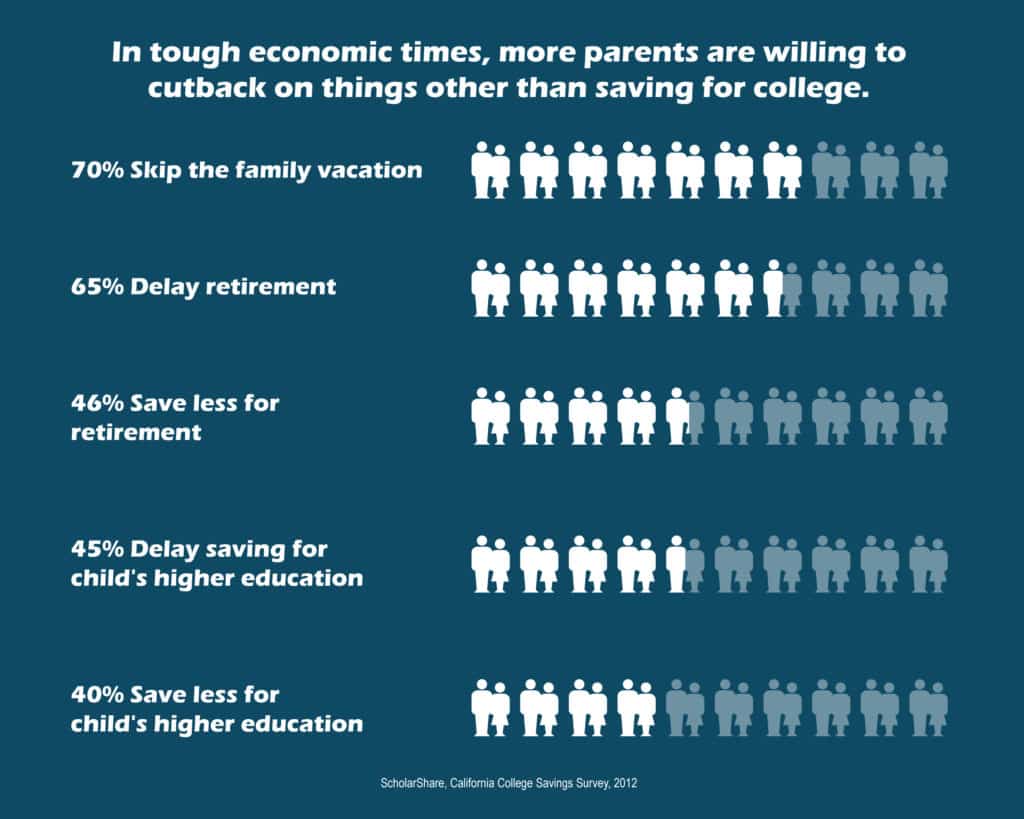

I know some parents or people are dealing with these rough economic times and are living paycheck to paycheck. I know you think how can I save when I can’t afford to? Here are some of the things parents are willing to cutback on to save for college.

More than three-quarters (78%) of California parents say that getting a higher education is more important today than it was 10 years ago. Parents of color are especially likely to highlight the importance of college, with 87% of Latino and African-American parents, and 84% of Asian parents indicating that higher education has become more important over the past decade.

Latino parents (particularly Spanish-dominant Latinos) are even more apt to say their children will attend community college (76%) or trade school (77%). However, Latino and Asian parents are more likely than Caucasian or African-American parents to say that their kids might pursue any of the post-secondary schools mentioned in the survey.

However, expectations on how children will attend college differs between ethnicities. Half of Latino and African-American parents, versus 36% of white parents and 43% of Asian parents expect scholarships to cover a majority of their college costs. This means a majority of families aren’t planning for the future.

Overall, Latino parents, especially Spanish-dominant Latinos, have saved less than parents from other ethnic backgrounds.

Source: All stats from Hart Research Associates

Being a Latina myself I know that college should be a must for our children and we should all take an active roll to learn more that is out there to save for our children’s youth.

Here are some more ScholarShare Features :

- The new ScholarShare plan significantly reduces fees, expands the investment lineup, and offers online and mobile tools to make California’s 529 plan more accessible and easier to manage.

- The minimum initial contribution to open an account is now only $25, down from $50 a year ago. Under the revamped plan, fees will be reduced by approximately 30 percent, making ScholarShare one of the lowest cost 529 plans in the country.

- The annual asset based management fees now range from 0.18 percent to 0.62 percent, vs. 0.25 percent to 1.06 percent with old plan. 4 additional investment portfolios (15 to 19), giving account holders more options, depending on their savings goals and risk tolerance.

- You can also compare different college saving choices to make the wisest selections for you and your beneficiary.

- The ScholarShare website will feature informational tools to help California families better prepare a college savings plan to meet their specific needs, including a new Risk Tolerance Questionnaire.

- For the on-the-go customer, ScholarShare launched a series of mobile-friendly services, including a mobile site with full account management capabilities and a mobile app called College Savings Planner, that allows customers to keep track of their college savings goals and plan to help meet them.

It’s a great program that I know I will be using from now on. For more info visit ScholarShare.com and for my Spanish speaking readers if you’d like this información en español visite este enlace. You can also follow ScholarShare on Twitter and Facebook!

Disclosure: This is a sponsored post from One2One Network and Scholarshare. All opinions stated are my own.

Comments

We know all about skipping vacations. 🙁

Thanks for sharing this! My husband and I were just talking about having people donate money to the girls’ college fund for their bdays.

I’m feeling so blessed that our daughter will probably get a full academic scholarship because I’m not sure we would have been prepared for the cost of college otherwise.